What is a Summary Suit and When Can It Be Used?

A summary suit under Order 37 of the Code of Civil Procedure, 1908 is a legal mechanism crafted for swift and decisive debt recovery. Unlike ordinary civil suits, it limits the defendant’s right to defend unless permission is sought and granted. This fast-track remedy is especially potent when the liability is clear and arises from written agreements or instruments.

In Delhi, courts routinely entertain summary suits fxor commercial debts backed by promissory notes, bills of exchange, cheques, or written contracts. If you hold a signed acknowledgement of debt or an unpaid invoice with unambiguous terms, you’re likely eligible to initiate an Order 37 summary suit in Delhi.

However, the remedy is not universal. Disputes involving oral agreements, claims for damages, or matters requiring factual inquiry typically fall outside its scope. The summary suit route is meant for situations where the debt is undisputed and documented — a domain best suited for recovery on the strength of written instruments.

This form of action is increasingly relied upon by businesses and individuals alike for fast debt recovery in Delhi, especially when time is of the essence, and the debtor is either uncooperative or evasive.

Eligibility Criteria for Filing a Summary Suit in Delhi

Not every creditor can resort to the summary suit procedure. To invoke Order 37 CPC, the claim must meet certain legal thresholds. Here’s what qualifies under this special jurisdiction:

1. Nature of the Claim

The suit must be based on:

- A bill of exchange

- A hundi

- A promissory note

- A written contract (including invoices or acknowledged debt instruments)

- A guarantee wherein the liability is determined by a written instrument

2. No Need for Oral Evidence

If your case requires detailed examination of oral testimony or disputed facts, it won’t be accepted under Order 37 summary suit in Delhi. The court should be able to assess liability purely on documents.

3. The Defendant Must Be a Debtor, Not Just a Disputant

Summary suits are meant for clear-cut liabilities. If the debtor disputes the very existence of a contract, or if the nature of the dispute is complex, the court may direct the matter to be tried as an ordinary civil suit.

4. Filing Within Limitation

As per the Limitation Act, most contractual debts must be recovered within three years of default. Summary suits are no exception. Delay beyond this period, without acceptable cause, will render the suit time-barred.

5. Jurisdiction of Delhi Courts

Your cause of action must either arise within Delhi, or the defendant must reside, carry on business, or work for gain in Delhi. The Delhi High Court has also framed rules that streamline summary suits in its original civil jurisdiction, offering claimants the benefit of experienced benches and efficient procedures.

By ensuring your claim meets these tests, you gain access to the summary suit procedure in Delhi that offers precision, speed, and the authority of documentary proof.

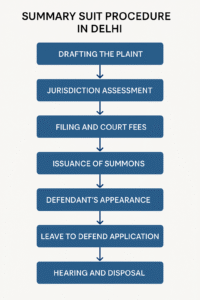

Step-by-Step Filing Procedure for Summary Suit in Delhi

Filing a summary suit under Order 37 CPC in Delhi involves a deliberate legal process. Precision in drafting and procedural compliance can be the difference between immediate relief and avoidable delay. Here’s a breakdown of the filing process:

1. Drafting the Plaint

Begin with a well-structured plaint clearly stating:

- The nature of the claim

- The amount due

- The instrument relied upon (such as invoice, promissory note, cheque, or written agreement)

- That the suit is being filed under Order 37 and falls within its scope

- Attach copies of all supporting documents and ensure signatures are properly endorsed.

2. Jurisdiction Assessment

File the suit before the appropriate court depending on:

- The pecuniary value (District Court or High Court, Original Side)

- Territorial nexus (where the defendant resides or where the cause of action arose)

3. Filling and Court Fees

Submit the plaint along with requisite ad valorem court fees as per the Court Fees Act applicable in Delhi. Stamp duty on the documents may also be examined at this stage.

4. Issuance of Summons under Order 37 Rule 2(2)

Once the suit is admitted, the court issues a special summons to the defendant — not an ordinary one. The summons must explicitly state that the suit has been filed under Order 37, and that the defendant has only ten days to enter an appearance.

5. Defendant’s Appearance

Upon service, the defendant must file an appearance within ten days. If they fail, the plaintiff becomes entitled to a decree forthwith.

6. Leave to Defend Application

If the defendant appears, they must apply for leave to defend — showing a substantial defence or triable issue. If they fail to demonstrate a valid reason, the court may refuse leave and pass a decree.

7. Hearing and Disposal

Where leave is granted, the suit is converted into a regular civil trial. If denied, a summary decree is passed. In practice, Delhi courts expedite summary suits significantly, especially when supported by complete documentation.

Delhi-Specific Jurisdictional Nuances in Summary Suits

| Delhi-Specific Jurisdictional Aspect | Explanation |

| Dual Court Access | Claims above ₹2 crore are filed in the Delhi High Court (Original Side); claims below that go to District Courts. |

| Integration with Commercial Courts Act | Claims above ₹3 lakh and of a commercial nature are tried under the Commercial Courts Act, 2015, ensuring faster disposal. |

| E-filing and Digital Support | Delhi courts provide online filing, virtual hearings, and digital case tracking — ideal for document-based summary suits. |

| Enforcement of Timelines | Delhi courts, especially under the Commercial setup, rigorously enforce deadlines, reducing procedural delays. |

| Bench Expertise | Judicial officers in Delhi are experienced in commercial litigation and Order 37 CPC, leading to efficient and consistent rulings. |

Why Summary Suits Are Better Than Regular Civil Suits for Quick Debt Recovery

When it comes to reclaiming unpaid dues, speed is not just a preference — it’s a necessity. The summary suit procedure Delhi provides exactly that: a clear route to resolution without getting dragged into prolonged litigation. Here’s why summary suits under Order 37 are a superior option for fast debt recovery Delhi, especially in the context of contractual defaults and written instruments:

- Limited Right to Defend: Unlike regular civil suits where the defendant can freely file a written statement, a summary suit shifts the burden. The defendant must seek the court’s permission to defend. If the defence is weak or frivolous, permission is denied outright. That alone cuts months off the timeline.

- No Framing of Issues or Oral Evidence (Initially): Since the liability arises from a written document, the court does not frame detailed issues or invite oral testimony at the start. The process is purely documentary unless a serious triable issue is shown.

- Early Judgments: If the defendant doesn’t appear within ten days or fails to get leave to defend, the court may pass a judgment right away. In contrast, regular suits often languish at the admission stage for months.

- Legal Presumption of Debt: Instruments like cheques and promissory notes carry a legal presumption of liability. This works strongly in favour of the plaintiff and places the burden on the defendant to rebut, often unsuccessfully.

- Cost-Effective: Fewer hearings mean reduced legal fees, less court time, and less resource drain. For businesses chasing multiple recoveries, this adds up.

- Ideal for Written Instruments: If your case is based on signed contracts, dishonoured cheques, invoices, or debt acknowledgments, there’s no reason to choose a slower route. Summary suits are made for these scenarios.

Conclusion

In conclusion, a summary suit under Order 37 CPC is one of the most effective legal tools for fast debt recovery Delhi, especially when the claim is based on clear, written instruments. Its procedural edge — limited defence rights, document-driven adjudication, and swift decree — makes it the preferred route for creditors seeking to recover money without the delays of regular civil litigation. For claimants equipped with enforceable contracts, dishonoured cheques, or acknowledged debts, the summary suit procedure Delhi is not just efficient — it’s strategic.